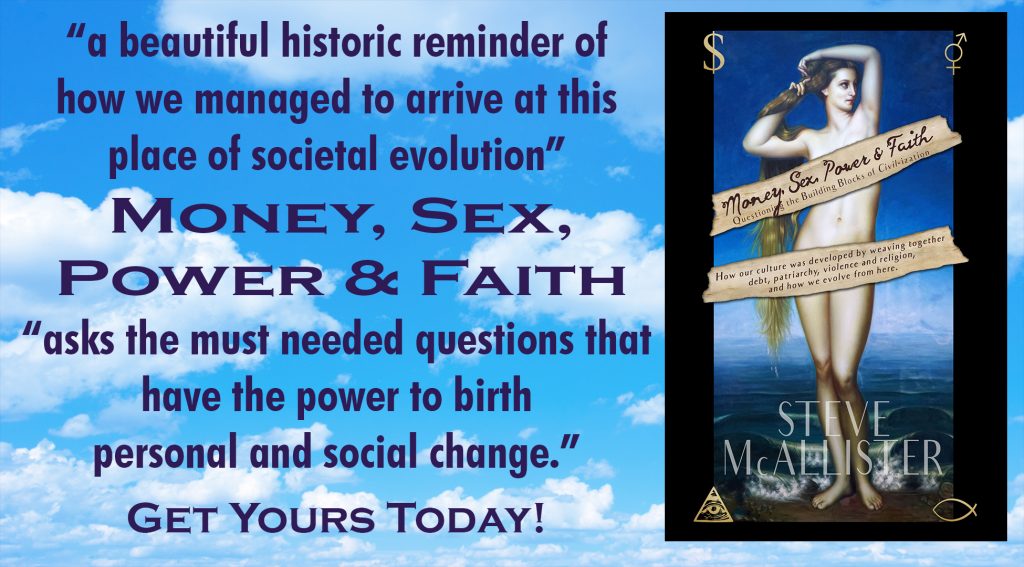

The following is a chapter from Money, Sex, Power & Faith.

Order your copy in paperback or for Kindle!

“Any intelligent fool can invent further complications, but it takes a genius to retain, or recapture, simplicity.”– Ernst F. Schumacher

Of course, in the grand scheme of things, the most recent recession isn’t some sort of isolated anomaly. According to Wikipedia, there have been forty-seven economic recessions since America instituted capitalism as the driving economic force, and fourteen since the Great Depression. Although defenders of finance claim that the capitalist system brings security and stability, with an average of more than one recession per decade for the last century, that sort of security doesn’t seem as stable as adherents want to think it is.

“There is a multitude of real assets in the world which constitutes our capital wealth,” the father of modern macroeconomics John Maynard Keynes pointed out in one of his essays, “buildings, stocks of commodities, goods in the course of manufacture and of transport, and so forth. The nominal owners of these assets, however, have not infrequently borrowed money in order to become possessed of them. To a corresponding extent the actual owners of wealth have claims, not on real assets, but on money.”

Due to the shortsightedness of the financial economy and the delusion that a man-made creation like money will follow some sort of natural law, we have found ourselves putting way too many of our eggs into a very flimsy basket. When economist Hyman Minsky pointed out the instability of our financial system a few decades ago, he was largely laughed at and ignored. However, after the crash of 2008, economists began to revisit his work.

In 1974, Minsky wrote that “a fundamental characteristic of our economy is that the financial system swings between robustness and fragility and these swings are an integral part of the process that generates business cycles.”135 In order to use money to create profit through this boom and bust scenario we keep playing out, we rely on the “Greatest Fool” theory to enact what Minsky stated were the five stages to the credit cycle: displacement, boom, euphoria, profit taking, and panic.

Displacement generally occurs when some fools who already have money find some way to make more, displacing their energy from a place of balanced equilibrium to yearning and excitement. When they get other fools excited and involved in their scheme, a boom is created, the price of whatever they’re selling goes up, and more fools keep buying it. As money moves from account to account and more fools get involved, the illusion of abundance creates a euphoria in which participating fools look for fools greater than themselves to pay exorbitant prices for something they didn’t even know they wanted. When the more advanced players of the game realize they’ve taken advantage of as many fools as they can, they cash out and take their profits, which pops the bubble everyone’s been inflating, resulting in a panic when everyone else realizes they’ve just been fooled.

Although economists, and people in general, are becoming more aware of the inevitability of bubbles like this occurring in the financial market, none have really come up with any good ways to get around them. Indeed, while it may seem foolish for people to pay inflated prices for something beyond its intrinsic value, considering that the US dollar has no intrinsic value itself, it would seem that putting so much emphasis on its value as to wager the entirety of the economy on it is equally, if not even more foolish.

By making money of prime importance in our economy, we actually make our true economy less stable. As Paul Hawken reminded, “The ultimate purpose of business is not, or should not be, simply to make money. Nor is it merely a system of making and selling things. The promise of business is to increase the general well-being of humankind through service, a creative invention, and ethical philosophy. Making money is, on its own terms, totally meaningless, an insufficient pursuit for the complex and decaying world we live in. We have reached an unsettling and portentous turning point in industrial civilization.”

“Capitalism began as a theory about how the economy functions,” explains Yuval Noah Harari in Sapiens. “It was both descriptive and prescriptive – it offered an account of how money worked and promoted the idea that reinvesting profits in production leads to fast economic growth. But capitalism gradually became far more than just an economic doctrine. It now encompasses an ethic – a set of teachings about how people should behave, educate their children and even think. Its principal tenet is that economic growth is the supreme good, or at least a proxy for the supreme good, because justice, freedom, and even happiness, all depend on economic growth.”2

What we did not understand when we started keeping ledgers, minting coins, printing dollars, or even developing stock, was that every time we create a unit of money, we have to make it out of something. Although it seems that every derivative, speculation, hedge fund, or unit of interest that creates each of these bubbles is made of nothing more than empty promises, to make a dollar requires the churning of the earth, the labor of humans, the development of waste, and much more activity than is probably necessary. Should this activity lead to a higher quality of life for the entirety of the planet, great, but when it’s only serving a small and selfish fraction of the population, leaving the rest merely tired, worn, and emptied, it seems much more costly to the rest of the planet and future generations.

Like money itself, the tools for turning finance into capital, instead of actual, tangible reality, are largely the products of human imagination. These days, players in the financial market are given all sorts of interesting imaginary toys through which they can speculate about what could possibly be, derived from mortgage backed securities, credit default swaps, collateralized debt obligations, and CDO tranches, both squared and cubed. All of these fancy terms are thrown around in a flurry of excitement, and a lot of money moves from account to account, but very little of it actually affects the lives of everyday people, other than the natural resources, personal property, and human labor that must be sacrificed in order to enable these fools to continue blowing bubbles. Likewise, other than the players of the game who get their accounts to grow, few are really being served.

As Minsky said, “The capital development of a capitalist economy is accompanied by exchanges of present money for future money.”134 Unfortunately, we are sacrificing quality of life for the future of Earth by following the “very type of short-term, risky thinking that nearly toppled the global economy in 2008… widening the gap between rich and poor, hampering economic progress, and threatening the future of the American Dream itself,” Foroohar reminds us in Makers and Takers.

Our preoccupation with money and the shortsightedness of the materialism it represents is indeed indicative of the immaturity of our society. For Americans especially, compared to other industrialized nations, we are mere teenagers in our development.

“We live in an adolescent society,” asserts Daniel Prokop in Leaving Neverland: Why Little Boys Shouldn’t Run Big Corporations, “Neverland, where never growing up seems more the norm than the exception. Little boys wearing expensive suits and adult bodies should not be allowed to run big corporations. They shouldn’t be allowed to run governments, armies, religions, small businesses, and charities either, and just quietly, they make pretty shabby husbands and fathers too. Mankind has become Pankind and whilst ‘lost boys’ abound, there is also an alarming increase in the number of ‘lost girls.’”

Ultimately, if we are giving the greater amount of our energies, intentions, talents, skills, and resources for the sake of merely making money instead of providing avenues toward food, water, shelter, clothing, healthcare, education, and opportunity for all, we must question if we are dealing with simple folly, or if we have delved into outright insanity. In describing The Sane Society, Eric Fromm offered a pointed reminder about the dangers of an insane society. “The fact that millions of people share the same vices does not make these vices virtues, the fact that they share so many errors does not make the errors to be truths, and the fact that millions of people share the same form of mental pathology does not make these people sane.”

After all, we are now a society that imagines that corporations, with no hearts, minds, bodies, or spirits, are actually people and deserving of the same rights as human beings. In our myopic pursuit of value’s proxy, we have sacrificed a great amount of true wealth, and must truly reconcile ourselves with whether or not it has been worth it. More importantly, we should ask ourselves if we should continue with our quest for the elusive lucre.

“The potency of industrial systems is overwhelming,” explains Paul Hawken in The Ecology of Commerce. “No culture in the world has been able to resist the allure, convenience, ease, and wonder of materialism. Industrial corporations have overturned thousands of years of beliefs and practices, sometimes overnight, replacing cultural traditions that linked human welfare to deities and great natural laws with a managerial system that showed how mankind could intervene with, overturn, and even replace natural law with engineering, mechanics, technology, and systems. The growing power of corporations has not been accompanied by any comprehensive philosophy, any ethical construct, other than the accumulation of wealth as an end in itself. Very few principles guide the commercial conduct of corporations other than those randomly adduced or self-proclaimed. Everyone – managers, employees, customers – is left in limbo.”

Repeatedly, when the bubbles have burst every decade or so, we feel the repercussions of chasing these delusions, drowning ourselves in the ineptitude of our folly. We invest so much of our lives, our hopes, and our resources into this system of finance and the freedom it promises, yet we continually find ourselves disillusioned, and few of us stop to ask why. Is making money really the point of our being here and creating this thing we call civilization? Especially when, like in 2017, 82% of the profit developed in the United States went to 1% of the population, the rest of us should be asking, “Is all this really necessary?”

Every time we see a growth in monetary profits, a rise in GDP, or any other way to make more money, we’re indoctrinated to think that all is great in the world, and for the world. However, if every minor financial bubble humans inflate bursts, isn’t it reasonable to assume that one day the entire structure will burst as well? Could it be that the reason hedge funds, derivatives, and speculations so often evolve into Ponzi schemes is because the foundation of the system is a Ponzi scheme in itself?

Order your copy of Money, Sex, Power & Faith today!